Wallet Fitness is about turning one of Americans’ top stressors, money, into one of your biggest strengths. It means building an excellent credit score and never again overpaying for financial products. It means minimizing debt and protecting yourself with adequate insurance coverage. Most importantly, it means spending modestly while saving aggressively for retirement and emergencies.

But Wallet Fitness levels vary widely across the U.S. As we prepare to make resolutions for self-improvement, it’s fair to wonder who’s best positioned for financial success and who has the most work to do. To find out, we compared more than 180 U.S. cities based on 32 key indicators of Wallet Fitness. You can find the results below, followed by WalletHub’s 6 Tips for Reaching Top Wallet Fitness and a Q&A with a panel of money-management experts.

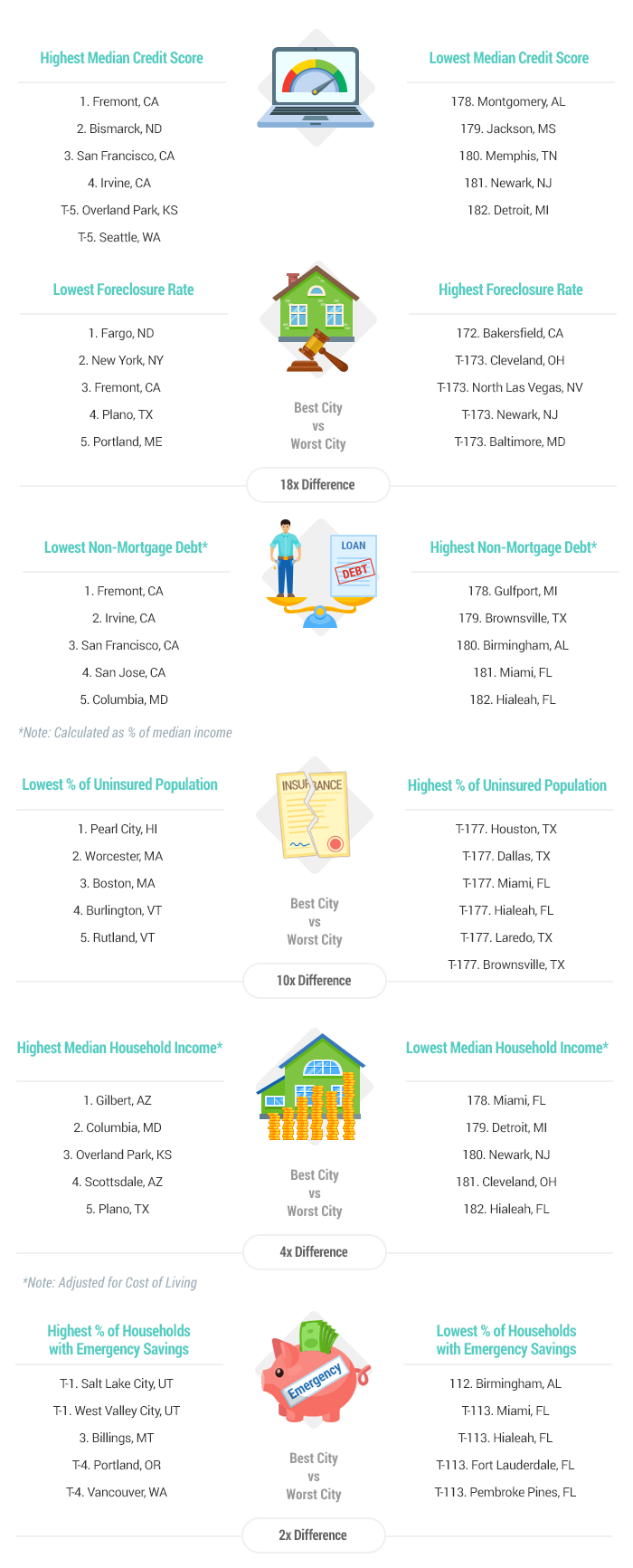

Main Findings

Best Cities for Wallet Fitness

| Overall Rank (1 = Best) |

City | Total Score | ‘Credit Standing’ Rank | ‘Responsible Spending’ Rank | ‘Savings’ Rank | ‘Risk Exposure’ Rank | ‘Earning Power’ Rank |

|---|---|---|---|---|---|---|---|

| 1 | Fremont, CA | 66.42 | 1 | 19 | 89 | 1 | 29 |

| 2 | Seattle, WA | 65.84 | 12 | 65 | 4 | 18 | 14 |

| 3 | San Francisco, CA | 65.47 | 3 | 60 | 48 | 2 | 28 |

| 4 | San Jose, CA | 64.65 | 32 | 93 | 3 | 4 | 63 |

| 5 | Madison, WI | 64.20 | 2 | 5 | 33 | 27 | 40 |

| 6 | Boise, ID | 64.10 | 21 | 2 | 34 | 40 | 26 |

| 7 | Minneapolis, MN | 62.09 | 35 | 44 | 5 | 90 | 18 |

| 8 | Overland Park, KS | 61.43 | 96 | 25 | 35 | 33 | 5 |

| 9 | Orlando, FL | 61.33 | 81 | 41 | 8 | 94 | 7 |

| 10 | Pearl City, HI | 60.94 | 6 | 32 | 36 | 31 | 69 |

| 11 | St. Paul, MN | 60.91 | 38 | 49 | 12 | 86 | 19 |

| 12 | Columbia, MD | 60.75 | 88 | 21 | 40 | 91 | 3 |

| 13 | San Diego, CA | 60.75 | 59 | 101 | 15 | 11 | 56 |

| 14 | Washington, DC | 60.38 | 90 | 23 | 10 | 59 | 37 |

| 15 | Boston, MA | 59.93 | 7 | 82 | 27 | 48 | 58 |

| 16 | Irvine, CA | 59.85 | 17 | 118 | 109 | 3 | 25 |

| 17 | Warwick, RI | 59.62 | 55 | 39 | 77 | 7 | 72 |

| 18 | Buffalo, NY | 59.03 | 23 | 3 | 1 | 71 | 153 |

| 19 | Honolulu, HI | 58.95 | 4 | 78 | 26 | 34 | 128 |

| 20 | Bismarck, ND | 58.46 | 9 | 42 | 123 | 100 | 11 |

| 21 | Cedar Rapids, IA | 58.26 | 42 | 4 | 137 | 35 | 65 |

| 22 | Des Moines, IA | 58.16 | 70 | 11 | 44 | 52 | 55 |

| 23 | Raleigh, NC | 58.14 | 69 | 70 | 37 | 87 | 13 |

| 24 | Portland, OR | 58.01 | 46 | 149 | 13 | 67 | 24 |

| 25 | Sacramento, CA | 57.99 | 123 | 91 | 19 | 15 | 76 |

| 26 | Plano, TX | 57.98 | 78 | 16 | 98 | 75 | 9 |

| 27 | Austin, TX | 57.83 | 57 | 110 | 51 | 121 | 2 |

| 28 | Billings, MT | 57.79 | 28 | 27 | 76 | 69 | 74 |

| 29 | Scottsdale, AZ | 57.34 | 72 | 129 | 114 | 17 | 4 |

| 30 | Denver, CO | 57.04 | 45 | 174 | 16 | 44 | 15 |

| 31 | Tacoma, WA | 56.98 | 93 | 63 | 21 | 54 | 82 |

| 32 | Grand Rapids, MI | 56.96 | 15 | 22 | 59 | 63 | 100 |

| 33 | Santa Rosa, CA | 56.94 | 5 | 160 | 150 | 9 | 98 |

| 34 | Pittsburgh, PA | 56.58 | 63 | 126 | 31 | 95 | 30 |

| 35 | Salt Lake City, UT | 56.41 | 98 | 117 | 23 | 125 | 6 |

| 36 | Columbus, OH | 56.28 | 95 | 48 | 24 | 89 | 70 |

| 37 | Lincoln, NE | 56.24 | 18 | 13 | 139 | 80 | 66 |

| 38 | Durham, NC | 56.18 | 66 | 61 | 78 | 112 | 10 |

| 39 | Colorado Springs, CO | 56.15 | 91 | 119 | 87 | 24 | 42 |

| 40 | Gilbert, AZ | 56.07 | 140 | 121 | 122 | 16 | 1 |

| 41 | Huntington Beach, CA | 55.89 | 50 | 145 | 131 | 6 | 34 |

| 42 | Nashua, NH | 55.74 | 24 | 57 | 93 | 117 | 59 |

| 43 | Charlotte, NC | 55.61 | 82 | 146 | 6 | 107 | 52 |

| 44 | Cheyenne, WY | 55.47 | 31 | 50 | 157 | 110 | 16 |

| 45 | Rutland, VT | 55.46 | 20 | 14 | 163 | 47 | 124 |

| 46 | Fargo, ND | 55.42 | 34 | 97 | 83 | 101 | 41 |

| 47 | Spokane, WA | 55.18 | 39 | 59 | 85 | 41 | 99 |

| 48 | Oakland, CA | 55.15 | 49 | 128 | 80 | 13 | 117 |

| 49 | Rochester, NY | 55.10 | 61 | 10 | 2 | 93 | 166 |

| 50 | Atlanta, GA | 55.09 | 152 | 103 | 18 | 114 | 17 |

| 51 | Modesto, CA | 55.04 | 65 | 35 | 88 | 21 | 141 |

| 52 | Omaha, NE | 54.90 | 105 | 89 | 29 | 104 | 47 |

| 53 | Lexington-Fayette, KY | 54.89 | 30 | 31 | 151 | 45 | 95 |

| 54 | Nampa, ID | 54.70 | 75 | 7 | 45 | 124 | 134 |

| 55 | Chandler, AZ | 54.62 | 130 | 123 | 120 | 23 | 8 |

| 56 | Nashville, TN | 54.58 | 58 | 171 | 41 | 37 | 38 |

| 57 | Sioux Falls, SD | 54.58 | 56 | 155 | 68 | 57 | 35 |

| 58 | St. Petersburg, FL | 54.50 | 131 | 43 | 105 | 53 | 27 |

| 59 | Tampa, FL | 54.40 | 142 | 38 | 82 | 65 | 36 |

| 60 | Manchester, NH | 54.16 | 29 | 73 | 91 | 113 | 86 |

| 61 | Portland, ME | 54.00 | 11 | 175 | 30 | 106 | 39 |

| 62 | Cincinnati, OH | 53.90 | 76 | 24 | 61 | 108 | 119 |

| 63 | Vancouver, WA | 53.74 | 68 | 153 | 22 | 39 | 139 |

| 64 | Burlington, VT | 53.50 | 10 | 122 | 160 | 70 | 84 |

| 65 | New York, NY | 53.42 | 27 | 172 | 17 | 46 | 151 |

| 66 | Rapid City, SD | 53.41 | 19 | 88 | 124 | 111 | 73 |

| 67 | Worcester, MA | 53.40 | 43 | 20 | 58 | 62 | 170 |

| 68 | Oklahoma City, OK | 53.38 | 125 | 51 | 57 | 105 | 68 |

| 69 | Oceanside, CA | 53.31 | 86 | 143 | 70 | 12 | 145 |

| 70 | Lewiston, ME | 53.27 | 8 | 9 | 152 | 140 | 83 |

| 71 | Chattanooga, TN | 53.25 | 118 | 67 | 69 | 51 | 96 |

| 72 | Jersey City, NJ | 53.24 | 16 | 98 | 86 | 99 | 104 |

| 73 | Jacksonville, FL | 53.11 | 164 | 76 | 60 | 55 | 64 |

| 74 | Kansas City, MO | 53.07 | 156 | 56 | 28 | 118 | 81 |

| 75 | Virginia Beach, VA | 53.05 | 168 | 125 | 42 | 81 | 33 |

| 76 | Charleston, SC | 52.96 | 77 | 115 | 140 | 85 | 22 |

| 77 | Peoria, AZ | 52.86 | 150 | 131 | 128 | 26 | 12 |

| 78 | Louisville, KY | 52.80 | 116 | 104 | 74 | 50 | 94 |

| 79 | Chula Vista, CA | 52.70 | 134 | 136 | 67 | 10 | 137 |

| 80 | Yonkers, NY | 52.62 | 54 | 95 | 94 | 58 | 110 |

| 81 | Baltimore, MD | 52.53 | 132 | 47 | 11 | 165 | 113 |

| 82 | Fort Wayne, IN | 52.37 | 33 | 12 | 147 | 83 | 136 |

| 83 | Juneau, AK | 52.24 | 40 | 77 | 176 | 136 | 20 |

| 84 | Charleston, WV | 52.22 | 22 | 1 | 171 | 130 | 109 |

| 85 | Rancho Cucamonga, CA | 52.14 | 137 | 148 | 145 | 5 | 44 |

| 86 | Chesapeake, VA | 52.03 | 176 | 109 | 56 | 66 | 51 |

| 87 | Santa Clarita, CA | 51.82 | 141 | 154 | 125 | 8 | 57 |

| 88 | Henderson, NV | 51.81 | 167 | 62 | 112 | 36 | 54 |

| 89 | Tallahassee, FL | 51.81 | 74 | 124 | 149 | 68 | 79 |

| 90 | Philadelphia, PA | 51.68 | 128 | 55 | 20 | 146 | 134 |

| 91 | Tulsa, OK | 51.56 | 104 | 71 | 47 | 127 | 123 |

| 92 | Irving, TX | 51.49 | 67 | 40 | 102 | 171 | 46 |

| 93 | Huntsville, AL | 51.28 | 99 | 17 | 156 | 77 | 105 |

| 94 | Aurora, CO | 51.27 | 80 | 177 | 62 | 61 | 48 |

| 95 | St. Louis, MO | 51.26 | 79 | 105 | 50 | 154 | 87 |

| 96 | Baton Rouge, LA | 51.22 | 149 | 18 | 53 | 126 | 149 |

| 97 | Albuquerque, NM | 51.16 | 114 | 69 | 90 | 88 | 116 |

| 98 | Indianapolis, IN | 50.89 | 103 | 139 | 38 | 103 | 131 |

| 99 | Glendale, CA | 50.82 | 48 | 169 | 130 | 14 | 102 |

| 100 | Los Angeles, CA | 50.79 | 53 | 180 | 46 | 42 | 122 |

| 101 | Providence, RI | 50.67 | 44 | 80 | 63 | 64 | 181 |

| 102 | Chicago, IL | 50.64 | 144 | 106 | 7 | 159 | 140 |

| 103 | Las Vegas, NV | 50.56 | 146 | 81 | 71 | 119 | 85 |

| 104 | Phoenix, AZ | 50.52 | 133 | 142 | 65 | 116 | 53 |

| 105 | Fort Worth, TX | 50.39 | 157 | 45 | 79 | 166 | 49 |

| 106 | Mesa, AZ | 50.37 | 94 | 138 | 111 | 76 | 75 |

| 107 | Tempe, AZ | 50.32 | 155 | 137 | 115 | 74 | 23 |

| 108 | Knoxville, TN | 50.31 | 85 | 152 | 95 | 60 | 113 |

| 109 | Missoula, MT | 50.24 | 14 | 163 | 170 | 82 | 101 |

| 110 | Stockton, CA | 50.19 | 47 | 100 | 117 | 28 | 176 |

| 111 | Bakersfield, CA | 50.19 | 138 | 53 | 129 | 43 | 125 |

| 112 | Salem, OR | 50.16 | 83 | 135 | 175 | 84 | 71 |

| 113 | Fresno, CA | 50.01 | 60 | 116 | 100 | 49 | 172 |

| 114 | Milwaukee, WI | 49.89 | 100 | 147 | 9 | 139 | 157 |

| 115 | Pembroke Pines, FL | 49.85 | 143 | 64 | 164 | 32 | 60 |

| 116 | Reno, NV | 49.83 | 36 | 167 | 181 | 56 | 91 |

| 117 | Springfield, MO | 49.82 | 26 | 102 | 146 | 131 | 106 |

| 118 | Long Beach, CA | 49.81 | 71 | 170 | 110 | 22 | 107 |

| 119 | Garden Grove, CA | 49.81 | 25 | 176 | 132 | 19 | 130 |

| 120 | Port St. Lucie, FL | 49.79 | 126 | 127 | 162 | 79 | 67 |

| 121 | Grand Prairie, TX | 49.77 | 170 | 34 | 107 | 156 | 31 |

| 122 | West Valley City, UT | 49.74 | 174 | 107 | 39 | 163 | 45 |

| 123 | Cape Coral, FL | 49.60 | 117 | 111 | 180 | 72 | 32 |

| 124 | Dallas, TX | 49.33 | 121 | 114 | 43 | 177 | 78 |

| 125 | New Haven, CT | 49.31 | 37 | 30 | 32 | 149 | 175 |

| 126 | Aurora, IL | 49.20 | 112 | 85 | 73 | 122 | 147 |

| 127 | Richmond, VA | 49.15 | 102 | 92 | 64 | 144 | 97 |

| 128 | Arlington, TX | 49.12 | 136 | 36 | 101 | 160 | 89 |

| 129 | Detroit, MI | 49.05 | 135 | 8 | 49 | 173 | 169 |

| 130 | Dover, DE | 49.00 | 120 | 99 | 168 | 98 | 80 |

| 131 | Newport News, VA | 48.96 | 165 | 75 | 55 | 138 | 126 |

| 132 | Fort Lauderdale, FL | 48.89 | 153 | 86 | 148 | 102 | 21 |

| 133 | Amarillo, TX | 48.65 | 89 | 46 | 172 | 169 | 43 |

| 134 | Garland, TX | 48.63 | 106 | 33 | 106 | 174 | 92 |

| 135 | Anaheim, CA | 48.43 | 51 | 179 | 118 | 29 | 121 |

| 136 | Greensboro, NC | 48.39 | 109 | 87 | 96 | 135 | 103 |

| 137 | Casper, WY | 48.22 | 92 | 37 | 158 | 162 | 77 |

| 138 | Little Rock, AR | 48.13 | 160 | 158 | 104 | 96 | 62 |

| 139 | Houston, TX | 48.04 | 108 | 130 | 25 | 180 | 115 |

| 140 | Akron, OH | 48.02 | 113 | 15 | 72 | 151 | 155 |

| 141 | Lubbock, TX | 48.00 | 84 | 94 | 167 | 133 | 88 |

| 142 | Wilmington, DE | 47.90 | 122 | 120 | 97 | 115 | 142 |

| 143 | Anchorage, AK | 47.84 | 111 | 79 | 161 | 150 | 61 |

| 144 | Tucson, AZ | 47.80 | 64 | 134 | 133 | 109 | 127 |

| 145 | Riverside, CA | 47.78 | 127 | 165 | 136 | 20 | 111 |

| 146 | Glendale, AZ | 47.66 | 119 | 140 | 121 | 97 | 112 |

| 147 | Wichita, KS | 47.58 | 110 | 150 | 54 | 142 | 138 |

| 148 | Columbia, SC | 47.49 | 161 | 74 | 81 | 148 | 90 |

| 149 | Fort Smith, AR | 47.48 | 13 | 52 | 178 | 152 | 150 |

| 150 | Huntington, WV | 47.23 | 52 | 29 | 173 | 137 | 159 |

| 151 | Toledo, OH | 47.15 | 115 | 6 | 92 | 158 | 156 |

| 152 | San Antonio, TX | 47.08 | 171 | 162 | 66 | 145 | 50 |

| 153 | Norfolk, VA | 46.43 | 158 | 141 | 52 | 164 | 129 |

| 154 | Winston-Salem, NC | 46.31 | 107 | 68 | 103 | 147 | 148 |

| 155 | Ontario, CA | 45.64 | 124 | 173 | 141 | 25 | 144 |

| 156 | Fontana, CA | 45.48 | 166 | 164 | 143 | 30 | 120 |

| 157 | Birmingham, AL | 45.41 | 151 | 54 | 113 | 167 | 154 |

| 158 | Bridgeport, CT | 45.36 | 97 | 26 | 14 | 178 | 177 |

| 159 | North Las Vegas, NV | 45.14 | 179 | 90 | 116 | 128 | 118 |

| 160 | Corpus Christi, TX | 44.56 | 139 | 28 | 165 | 172 | 108 |

| 161 | Las Cruces, NM | 44.33 | 101 | 112 | 182 | 120 | 132 |

| 162 | Moreno Valley, CA | 44.04 | 172 | 166 | 144 | 38 | 143 |

| 163 | Miami, FL | 43.60 | 162 | 156 | 127 | 153 | 93 |

| 164 | Santa Ana, CA | 43.43 | 41 | 181 | 118 | 92 | 168 |

| 165 | Oxnard, CA | 43.31 | 62 | 182 | 135 | 78 | 171 |

| 166 | Augusta, GA | 43.21 | 154 | 83 | 134 | 143 | 158 |

| 167 | Mobile, AL | 42.99 | 173 | 66 | 154 | 123 | 167 |

| 168 | Jackson, MS | 42.93 | 180 | 113 | 126 | 141 | 163 |

| 169 | Montgomery, AL | 42.24 | 181 | 58 | 155 | 134 | 162 |

| 170 | Memphis, TN | 42.14 | 182 | 161 | 99 | 129 | 152 |

| 171 | San Bernardino, CA | 41.42 | 147 | 168 | 142 | 73 | 178 |

| 172 | New Orleans, LA | 41.33 | 159 | 178 | 108 | 132 | 164 |

| 173 | Shreveport, LA | 40.80 | 177 | 84 | 138 | 157 | 173 |

| 174 | Fayetteville, NC | 40.79 | 169 | 132 | 159 | 170 | 146 |

| 175 | El Paso, TX | 40.76 | 163 | 72 | 153 | 176 | 133 |

| 176 | Columbus, GA | 40.27 | 175 | 96 | 179 | 161 | 160 |

| 177 | Newark, NJ | 40.22 | 129 | 144 | 84 | 179 | 182 |

| 178 | Laredo, TX | 40.00 | 73 | 133 | 174 | 181 | 161 |

| 179 | Cleveland, OH | 39.72 | 178 | 159 | 75 | 175 | 179 |

| 180 | Gulfport, MS | 39.17 | 145 | 151 | 169 | 168 | 174 |

| 181 | Brownsville, TX | 38.03 | 87 | 108 | 177 | 182 | 165 |

| 182 | Hialeah, FL | 37.61 | 148 | 157 | 166 | 155 | 180 |

6 Tips For Top Wallet Fitness

Reaching top Wallet Fitness is challenging but not impossible. The following pointers will help you get there:

- Building Excellent Credit: Always pay your bill on time.

Payment history is the most important component of your credit score, making up at least 35 percent of your overall rating. Setting up automatic withdrawals from a bank account means you’ll never miss a due date and always pay on time. And if you’re wondering why great credit is important, just consider the fact that someone with excellent credit would save hundreds of thousands of dollars over a lifetime, compared to someone with bad credit.

- Minimizing Debt: Don’t allow luxuries to become necessities.

Getting used to the finer things in life can be dangerous. If such comforts cause your monthly spending to spiral out of control, it will only be a matter of time before your bad habits lead to delinquency and default. That can ruin your credit and make it more difficult to recover. Trying to play catchup will also leave you vulnerable to financial emergencies.

To prevent such bad outcomes, begin by strategically paying down what you owe. If you have balances on multiple credit cards, make minimum payments on all but the balance with the highest interest rate. On that one, you’ll make the biggest payment. When that balance is gone, repeat the process with your remaining balances until you’re debt-free. And once you’ve accomplished that, use only one credit card for everyday purchases. Everyday purchases, by definition, should be affordable without tapping into debt. So if you ever see finance charges on your everyday card, you’ll know you’re overspending.

- Getting the Best Deals: Make sure to comparison-shop.

It’s easy to assume you’re getting the best deal on your credit cards, loans and insurance policies, especially if you have above-average credit. But your needs and the offers available to you change regularly. So there’s a good chance you’ll find yourself leaving money on the table if you aren’t careful.

One of the best ways to ensure you always have the best deal is to sign up for a free WalletHub account. Not only will you receive your latest credit score and personalized advice for improvement, but WalletHub will also constantly monitor the market for upgrades. Whenever there’s something worth knowing about, you’ll receive a notification.

- Maximizing Earning Power: Train in a new skill.

The little things matter when it comes to financial success, but sometimes it’s more efficient to make a big move. You could pinch pennies for years and still end up with little savings compared to investing in your education to boost your money-making potential. Many colleges and universities today offer online classes, giving you the flexibility to work toward a degree without entirely uprooting your life. There are countless specialized training programs available, too, allowing you to cost-effectively learn a trade or at least pick up a new marketable skill.

- Preparing for Financial Emergencies: Plan for the worst, and hope for the best.

Unexpected events can spoil the most carefully laid plans if you aren’t prepared. While there’s no predicting exactly what might come your way or when, there’s little reason to leave your life to chance. At the least, you should begin building an emergency fund and buy adequate insurance coverage. That will help ensure an emergency doesn’t become a catastrophe.

- Saving for Retirement: Let compound interest work for you.

You really can’t start saving for retirement too early. The sooner you begin making contributions to a retirement account, the more compound interest will be able to work its magic and the less impactful underperforming investments will be.

Just consider the fact that someone who begins saving at age 25 needs to contribute about $450 per month to reach $1 million by age 65, assuming a 7 percent annual rate of return. Someone who starts at age 35, on the other hand, would have to save twice as much per month. So that 10-year head start therefore saves the early bird roughly $9,000 in total contributions.

Finally, our bonus tip is to sign up for a free WalletHub account. Not only will you receive access to your latest credit score and report, updated daily, but you’ll also benefit from 24/7 credit monitoring and personalized advice that will make top Wallet Fitness much easier to reach.

Ask the Experts: Wallet Fitness FAQs

For additional insight into achieving top Wallet Fitness, we asked a panel of experts who specialize in personal finance and behavioral economics the following key questions:

- What tips do you have on how people can improve their Wallet Fitness?

- When should an individual consider moving to an area that has better overall Wallet Fitness? When does location matter more than individual actions/behaviors?

- In evaluating the best cities for financial health, what are the top five indicators?

Ask the Experts

CFP ® – Founder, Heritage Financial Planning

Read More

CPA – Founder, Lulloff, Leben & Taylor, LLC

Read More

Dean, College of Social Science; MSU Foundation Professor of Economics, Michigan State University

Read More

Methodology

In order to determine the best cities for Wallet Fitness, WalletHub compared 182 cities — including the 150 most populated U.S. cities, plus at least two of the most populated cities in each state — across five key dimensions: 1) Credit Standing, 2) Responsible Spending, 3) Savings, 4) Risk Exposure and 5) Earning Power.

We evaluated those dimensions using 32 relevant metrics, which are listed below with their corresponding weights. Each metric was graded on a 100-point scale, with a score of 100 representing the most favorable conditions for achieving top Wallet Fitness. For metrics marked with an asterisk (*) data were available at state level only.

Finally, we determined each city’s weighted average across all metrics to calculate its overall score and used the resulting scores to rank-order our sample. In determining our sample, we considered only the city proper in each case, excluding cities in the surrounding metro area.

Credit Standing – Total Points: 20

- Median Credit Score: Triple Weight (~6.00 Points)

- Foreclosure Rate: Full Weight (~2.00 Points)

- Median Credit Card Debt per Person: Full Weight (~2.00 Points)

- Credit Utilization: Full Weight (~2.00 Points)

- Share of Underbanked & Unbanked Households: Full Weight (~2.00 Points)

- Share of Delinquent Debtors: Full Weight (~2.00 Points)

- Share of Credit-Denied Households: Full Weight (~2.00 Points)

Note: This metric measures the percentage of households that were denied bank credit in the past 12 months. - Share of Personal Bankruptcies: Full Weight (~2.00 Points)

Note: This metric measures the percentage of adults who declared bankruptcy in the past 12 months.

Responsible Spending – Total Points: 20

- Mortgage Debt per Person: Full Weight (~5.00 Points)

Note: This metric was calculated as a percentage of median earnings. - Non-Mortgage Debt per Person: Full Weight (~5.00 Points)

Note: This metric was calculated as a percentage of median earnings. Non-mortgage debt includes the following debt categories: credit card, student loan, car loan. - Income Volatility: Full Weight (~5.00 Points)

Note: This metric refers to the percentage of households whose income varied highly from month to month. - Share of Households Behind on Bills in the Past 12 Months: Full Weight (~5.00 Points)

Savings – Total Points: 20

- Share of Households with Emergency Savings: Full Weight (~4.00 Points)

Note: This metric measures the percentage of households that saved for unexpected expenses or emergencies in the past 12 months. - Share of Households with Retained Savings in Account: Full Weight (~4.00 Points)

- Financial Products Comparison: Full Weight (~4.00 Points)

Note: This metric measures the real intent of the population to compare “credit cards”, “mortgage rates”, “car insurance” and “car loans”. “Real intent” is measured using the average monthly search volumes for those specific terms. - Annual Consumer Savings-Account Average*: Full Weight (~4.00 Points)

- Retirement Plan Access & Participation Rate: Full Weight (~4.00 Points)

Note: “Retirement Plan” includes only employer-based plans.

Risk Exposure – Total Points: 20

- Share of Uninsured Population: Triple Weight (~6.67 Points)

- Exposure to Automobile Liability*: Full Weight (~2.22 Points)

Note: This metric is based on WalletHub’s “Most and Least Risky States for Drivers’ Wallets” ranking. - Share of Underwater Homes: Full Weight (~2.22 Points)

Note: “Underwater” describes homes with negative equity. - Unemployment Rate: Full Weight (~2.22 Points)

- Poverty Rate: Full Weight (~2.22 Points)

- Paid Family Leave*: Full Weight (~2.22 Points)

- Job Security: Full Weight (~2.22 Points)

Note: This metric was calculated using the following formula: (Number of Employees in 2017 - Number of Employees in 2016) / Number of Employees in 2016

Earning Power – Total Points: 20

- Median Annual Income: Triple Weight (~6.00 Points)

Note: This metric was adjusted for the cost of living. - Income Growth: Full Weight (~2.00 Points)

Note: “Growth” was measured by comparing 2012-2016 income figures. - Underemployment Rate for Workers with Bachelor’s Degree or Higher: Full Weight (~2.00 Points)

- Women’s Earnings: Full Weight (~2.00 Points)

Note: This metric was calculated as a percentage of men’s earnings. - Undereducated Rate: Full Weight (~2.00 Points)

Note: This measures the percentage of 25 years or older residents who did not graduate from high school - Job Seeker-Friendliness: Full Weight (~2.00 Points)

Note: This metric is based on WalletHub’s “Best & Worst Cities for Jobs” ranking. - 4+ Star Job Opportunities per Total People in Labor Force: Full Weight (~2.00 Points)

Note: This metric measures the number of job opportunities at 4+ star rated companies on Glasssdoor.com per the total people in the labor force. - Startup Friendliness: Full Weight (~2.00 Points)

Note: This measures the number of startups per capita.

Sources: Data used to create these rankings were obtained from the U.S. Census Bureau, U.S. Bureau of Labor Statistics, TransUnion, Council for Community and Economic Research, Zillow, RealtyTrac, National Conference of State Legislatures, Federal Deposit Insurance Corporation, Pitney Bowes, The Pew Charitable Trusts, Chmura Economics & Analytics, Center for Economic Studies, Glassdoor.com, Google and WalletHub research.

Image: William Potter / Shutterstock.com

WalletHub experts are widely quoted. Contact our media team to schedule an interview.