When shopping overseas, a merchant may ask you if you would like to convert your credit card transaction from the local currency into U.S. dollars. This is called Dynamic Currency Conversion (DCC). And while it may sound like an enticing offer, this conversion is very expensive for the cardholder and should be avoided.

Generally, when overseas merchants make this offer, they will use a conversion rate that is far higher than the actual going rate – as much as 7 percent higher – and pocket the difference as a fee. They get away with it because many customers are not checking the math at the point of sale.

Some customers incorrectly assume that if they do the currency conversion this way they can avoid the foreign transaction fee that 90% of credit cards charge. On the contrary, the credit card company will generally charge the foreign transaction fee in addition to the merchant charge related to Dynamic Currency Conversion. The credit card company is simply charging the customer for a transaction made abroad, not for the actual currency conversion.

By avoiding Dynamic Currency Conversion and using a credit card without a foreign transaction fee, you can save yourself an extra 10 percent (7 percent from DCC + 3 percent foreign transaction fee) on each of your purchases. Keep in mind that vigilance is required whether you’re shopping in person in a foreign country or with a foreign merchant online. Both DCC and foreign transaction fees are in play when you make purchases that are processed internationally, even if you are physically located in the U.S. when you make them.

Below you can find more details about Dynamic Currency Conversion as well as tips for minimizing your expenses when traveling abroad.

DCC Disclosure & Consent

As a customer, you are entitled to full disclosure of DCC, conversion rates, final costs and any other fees charged for the transaction. You also have a right to refuse DCC. If you refuse DCC at the point of sale but the charge later appears on your bill with an inflated currency conversion rate, you can dispute the charge with your issuing bank. If that doesn’t work, you can take up the issue with the relevant card network’s global compliance program.

However, keep in mind that requesting to reverse multiple charges can be a huge headache. Disputes often last a long time, and there’s no guarantee your request will be honored. The simplest way to avoid unnecessary charges and hassle is to pay in the local currency and refuse any offers to convert your transaction to your home currency.

Back Office DCC

Several years ago, merchants were not required to disclose to customers when DCC was used in a transaction. This process was known as “back office DCC.” But the new disclosure requirements from Visa and MasterCard have prevented further back office DCC from taking place. All credit card companies have outlawed the practice and imposed serious penalties on violators.

Still, a version of this practice persists: Many merchants automatically will select DCC without the customer’s consent when processing a transaction, though the customer will still see the conversion rates on the sales slip. But customers who are unfamiliar with DCC often won’t second-guess why the charge appears in their home currency. Other merchants will falsely claim that their POS terminals automatically converted the purchase price to the customer’s home currency.

In September 2013, several Brazilian banks stopped allowing DCC on credit card transactions at the recommendation of Brazil’s Association of Credit Card Companies and Services, or ABECS. For some time before making the suggestion, ABECS had received mounting complaints from Brazilian consumers who received confusing credit card statements that listed their purchases in dollars rather than reals, Brazil’s local currency.

PayPal Conversion Rate

You may be familiar with PayPal’s currency conversion service if you’ve ever used PayPal to do either of the following:

• Send or receive money in a foreign currency

• Make a purchase on eBay in a foreign currency

PayPal uses its own nomenclature (PayPal Conversion Rate) to refer to DCC, but the two essentially are identical. Here’s how PayPal’s conversion process works when you transfer money (applies only when using your credit card):

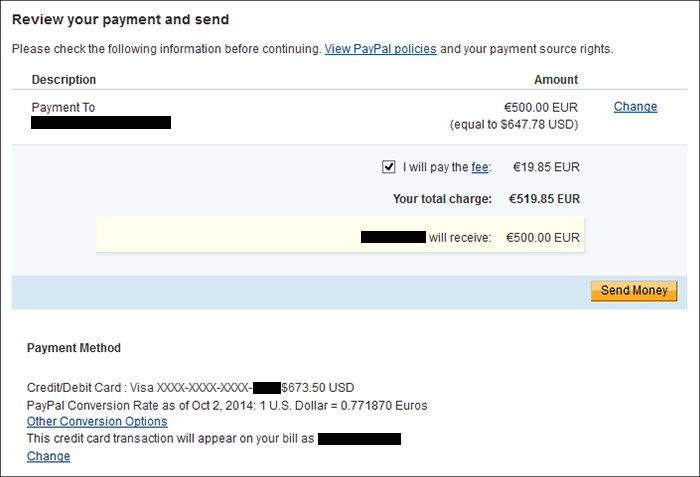

Before you finalize a transaction, PayPal will display the amount you wish to transfer expressed in the foreign currency and below it the amount converted to your home currency. When the transaction details appear, you’ll find under “Payment Method” the prevailing “PayPal Conversion Rate” to be used in the conversion listed as well.

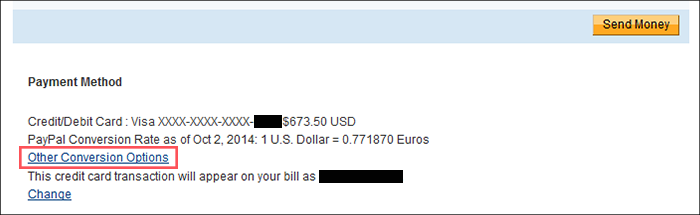

In the “Payment Method” section is also a link to “Other Conversion Options,” the first of which is PayPal’s own conversion process and the other Visa’s and MasterCard’s.

With each option, PayPal cleverly describes the possible outcome of each conversion method:

If you choose the PayPal method, a message gently assures you that it immediately will disclose “Both the original transaction currency and the converted amount” you are to be charged “for your convenience.” On the other hand, should you select the credit card issuer’s currency conversion process, PayPal cautions you that that the applicable foreign exchange rate will be withheld from you until your credit card billing statement arrives.

Problems with the Service

Many PayPal users have complained about two main problems with its currency conversion service:

1. When transferring money, customers often end up with an unfavorable exchange rate if they select the PayPal conversion method. Here’s an example:

Say the going exchange rate for Oct. 2, 2014 was actually USD 1.00 = EUR 0.794644 according to VISA. Had this rate been applied to €500.00, you would have paid only $629.21 for the transfer. But because PayPal lowered the exchange rate to USD 1.00 = EUR 0.771870, you ended up paying $647.78, or roughly 2.95% more.

2. If customers select the alternative, PayPal still displays the amount using its conversion rate to make it appear as if the same rate would have applied anyway. In other words, they try to convince customers that they might as well have opted for the PayPal service in the first place.

But choosing the credit card network’s conversion method can save a customer about 2.5 percent on each transaction. PayPal claims to offer “competitive” conversion rates based on the “most current exchange rate data” but doesn’t explicitly disclose any service fees. Instead, it offers a disadvantageous exchange rate to the customer and pockets the difference.

If a customer selects the PayPal conversion and wants to know exactly how it was calculated, PayPal posts the transaction details with the math on the customer’s “History” page.

Tips for Economizing

There are multiple ways to guard against the dangers of Dynamic Currency Conversion and protect your wallet. Keep the following tips in mind the next time you travel overseas.

- Apply for a No-Foreign-Fee Card

The best way to minimize your spending while traveling abroad is to get a no foreign transaction fee credit card. More than 90 percent of all credit card issuers charge fees for using their cards internationally, which could result in higher charges. Make sure you apply for a no foreign fee card before you book reservations or depart for your travels. Also compare your card options thoroughly. While some credit card companies – like Discover – don’t apply international service charges, where you can use them may also be more limited.

- Always Refuse DCC

While it’s tempting to see your transaction in a familiar currency, you should always refuse DCC and use a card that doesn’t charge foreign transaction fees. With such a card, you can save up to an extra 10 percent (7 percent DCC fee plus 3 percent foreign transaction fee) on each transaction. Keep in mind that DCC is not mandatory. If a merchant selects DCC without your permission (your receipt will display your total in your home currency and the local currency), you should ask the merchant to void the initial transaction before signing your receipt and run it again in the local currency.

- Beware of Deceptive ATMs

Some independently owned ATMs will offer DCC but disclose it ambiguously. To mask the service, they might offer to “lock in” or “guarantee” a conversion rate. You instead should select the option to “proceed without conversion.” Others might phrase it differently: “You can be charged in dollars: Press YES for dollars, NO for euros.” Always press NO and select the local currency.

- Announce Your Travel Plans

Make sure to always notify your credit card issuer of your travel plans, including dates and destinations. Some banks and credit card companies allow you to input that information online. You also can call customer service. That way, they won’t suspect fraudulent activity and suspend your account. You don’t want that when you’re in a foreign country.

- Download a Converter App

If you want to make sure you aren’t getting duped at the checkout counter, download a currency converter app on your smartphone. With an app like XE, you can draw current market exchange rates while you’re connected to a WiFi source or a cell network. The app then stores up to 10 exchange rates that you can access for future reference even when your phone is offline.

- Bring a Debit Card

You’ll always need cash for certain purchases when traveling abroad, so it’s a good idea to bring a low or no foreign fee debit card with you. This will enable you to withdraw cash as needed and, by doing so, minimize the chance of getting pick-pocketed as well as take advantage of the low exchange rate offered by Visa or MasterCard.

WalletHub experts are widely quoted. Contact our media team to schedule an interview.