Credit card rental car insurance can save you a truckload of money. You won’t have to buy supplemental insurance from the rental company, and even more importantly, it covers you in the event of damage to or theft of a rental car. Coverage up to the cash value of a rental vehicle is typical, and the best credit card rental car insurance policies give up to $75,000.

Credit card rental car insurance policies are driven by three of the four major card networks: Visa, Mastercard and American Express. The other major card network, Discover, stopped offering its rental car insurance benefit in 2018. But individual credit card companies determine the specifics of the coverage that customers receive.

To help consumers make informed decisions, WalletHub compared each major credit card company’s rental car insurance policy and selected the best credit cards for rental car insurance, out of 86 total offers.

Card information was collected on June 19, 2023. Opinions and ratings are our own. This study is not provided, commissioned or endorsed by any issuer. WalletHub independently collected information for some of the cards on this page.

2022’s Best Credit Cards for Rental Car Insurance

| Rank | Card | Coverage Duration | WalletHub Score |

|---|---|---|---|

| 1 | Chase Sapphire Reserve® | 31 days | 93.50% |

| 2 | Other Chase Consumer Visa Cards | 31 days | 91.00% |

| 3 | Capital One Venture X Rewards Credit Card | 31 days | 90.00% |

Main Findings

Best Issuer: Chase is the best credit card company for rental car insurance, covering cardholders for up to $75K and 31 days.

No Rental Coverage: Citi, Synchrony Bank, and Discover are the only major credit card companies that do not offer rental car insurance on any credit cards.

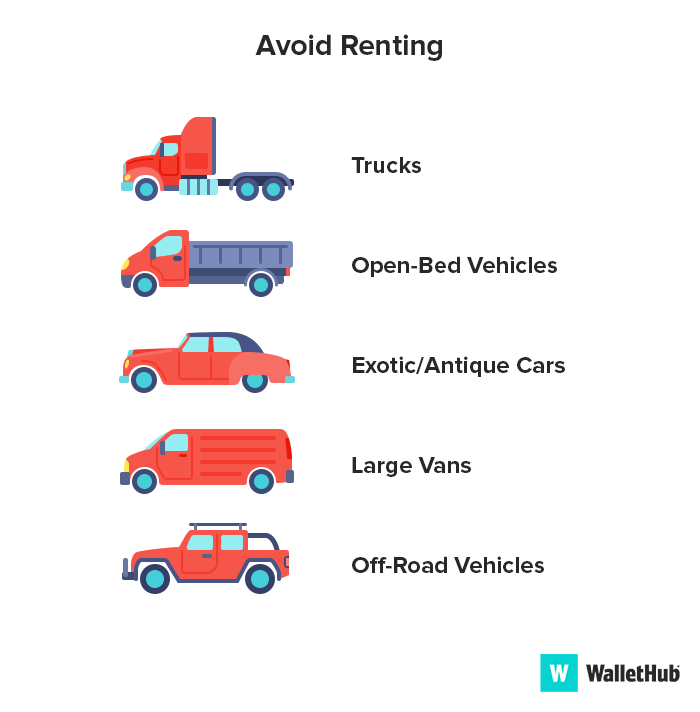

Avoid Renting: Trucks, open-bed vehicles, exotic/antique cars, large vans and off-road vehicles are usually excluded from coverage.

Coverage Duration: 43% of cards with rental car insurance only cover domestic rentals for up to 15 days.

Road Conditions: 40% of credit card rental car insurance policies won’t cover damage that occurs while driving on a dirt/gravel road.

Country Coverage: All Chase cards provide global coverage. Ireland, Northern Ireland, Israel and Jamaica are the most common exclusions among other issuers.

Tire & Rim Damage: 53% of credit card rental car insurance policies cover all rim/tire damage.

Loss-Of-Use Losses: Almost all cards will reimburse you for loss-of-use charges from the rental company, which can amount to hundreds of dollars.

Best Issuer for Business: Chase offers the best business credit cards for rental car insurance, covering cardholders for up to 31 days.

Typical Credit Card Rental Car Insurance Coverage

| Category | Example of a Standard Policy | Example of a Best Policy |

|---|---|---|

| Sign-Up | None required, but you must decline the rental company’s supplemental coverage | None required, but you must decline the rental company’s supplemental coverage |

| Type Of Coverage | Covers costs stemming from damage to or theft of rental vehicles | Covers costs stemming from damage to or theft of rental vehicles |

| Coverage Amount | The cost of repairs, the vehicle’s book value or the vehicle’s purchase price, whichever is lower. | Up to $75,000 |

| Maximum Coverage Duration | 30 days | 31 days |

| Vehicle Exclusions | Certain antique, exotic or luxury vehicles, vans, trucks, pick-ups, motorcycles and recreational vehicles. | Certain antique vehicles, vans, trucks, pick-ups, motorcycles and recreational vehicles. |

| Type-Of-Road Exclusions | Accidents occurring on dirt and gravel roads are covered | Accidents occurring on dirt and gravel roads are covered |

| Country Exclusions | Australia, Italy, New Zealand | None |

| Loss Of Use & Personal Insurance Deductible | Both Covered | Both Covered |

| Towing Costs | Covered | Covered |

| Tire & Rim Damage | Covers damage as a result of theft, vandalism or vehicle collision | Covered |

| Claims Process & Limits | Call card issuer’s benefits administrator; no claims limit | Call card issuer’s benefits administrator; no claims limit |

| Full Policy Details | American Express Rental Collision Policy | Chase Rental Collision Policy |

Business credit cards seem to offer similar benefits. However, business cards seem to have policy details slightly enhanced (e.g. covering 31 days instead of 15 days rentals) and a few cards even offer the policy as primary coverage instead of secondary.

How to File a Credit Card Car Rental Insurance Claim

| Issuer | Phone Number | Online Support |

|---|---|---|

| U.S: 1-800-338-1670 Outside U.S: 1-216-617-2500 | Here | |

| U.S: 1-800-348-8470 Outside U.S: 1-804-673-1164 | Here For Visa Here For Mastercard | |

| Visa U.S: 1-800-825-4062 Visa Outside U.S: 1-804-965-8071 Mastercard: 1-888-531-4227 | Here For Visa Here For Mastercard | |

| Sapphire Preferred: 1-888-320-9961 Freedom: 1-888-320-9656 Outside U.S: 1-804-673-1691 | Here For Visa | |

| Visa U.S: 1-800-397-9010 Visa Outside U.S: 1-303-967-1093 Mastercard: 1-800-627-8372 | Here For Visa Here For Mastercard | |

| Visa US: 1-800-348-8472 Visa Outside U.S: 1-804-673-1164 Mastercard: 1-800-627-8372 American Express: 1-866-643-6873 | Here For Visa Here For Mastercard Here For American Express | |

| Visa: 1-800-316-8051 Mastercard: 1-800-627-8372 | Here For Visa Here For Mastercard |

8 Money-Saving Car Rental Tips

We recommend taking the following steps to minimize the cost and liability associated with renting a car. Be safe out there!

- Call your insurance company to see if rentals are covered under your standard policy. Personal car insurance typically applies when you’re driving a rental in the U.S. or Canada, but if you don’t have comprehensive and collision insurance on your personal vehicle, you won’t have any coverage for damage to your rental car, either. Liability insurance is all you need to drive legally in many states, and that just covers other drivers’ expenses if you cause an accident.

- Call your credit card company to ask if any limitations apply to your card’s coverage, relative to your rental plans.

- Double-check with long-term rentals. They might not be covered by your auto insurance policy, due to time limits.Typically, your personal auto insurance will only cover your rental for a few weeks or months.

- Decide whether to mix business with pleasure. Your personal auto policy – if it even covers rentals – only applies when the vehicle is rented for personal use. So if you’re traveling for business check what other options are available for you.

- Get a rental like your everyday ride. Your personal auto insurance is more likely to cover your rental if you get a vehicle of similar value to your own car.

- Ask about adding an insurance rider (for a small fee) if your policy doesn’t cover a certain type of rental car.

- Consider a non-owner auto insurance policy as an alternative if you don’t own a car, and drive rental cars frequently.

- Make a plan before you hit the rental counter. You may want to accept a rental company’s liability insurance and collision damage waiver if you don’t have personal auto insurance and your credit card won’t give you enough coverage. In any case, you want to make an informed decision, not one based on panic at check-out. WalletHub’s guide to rental car insurance can help with that.

Detailed Findings

Credit card rental car insurance policies were previously evaluated at the network level, but we decided to examine coverage at the card level in 2016 after discovering discrepancies among offers on the same network and/or issued by the same company. Where no policy differences existed, cards were grouped by issuer or network for the sake of simplicity.

Personal Credit Cards

| Cards | Total Score | Vehicles Excluded | Clarity on Exclusions | Coverage Duration | Type of Road Exclusions | Country Exclusions | Loss of use and deductible on your auto insurance | Towing | Damage to tires and rims | Activation | Claims Process | Info Accessibility |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Max Score | 100.00% | 20.00% | 5.00% | 15.00% | 5.00% | 5.00% | 20.00% | 5.00% | 5.00% | 5.00% | 5.00% | 10.00% |

| Chase Sapphire Reserve® | 93.50% | 15.00% | 5.00% | 15.00% | 5.00% | 5.00% | 20.00% | 5.00% | 5.00% | 5.00% | 5.00% | 8.50% |

| Other Chase Consumer Visa Cards | 91.00% | 15.00% | 2.50% | 15.00% | 5.00% | 5.00% | 20.00% | 5.00% | 5.00% | 5.00% | 5.00% | 8.50% |

| All American Express Consumer Cards | 88.50% | 15.00% | 5.00% | 15.00% | 3.00% | 3.00% | 20.00% | 5.00% | 2.50% | 5.00% | 5.00% | 10.00% |

| U.S. Bank Altitude Reserve Visa Infinite® Card | 88.50% | 15.00% | 5.00% | 12.00% | 5.00% | 3.00% | 20.00% | 5.00% | 5.00% | 5.00% | 5.00% | 8.50% |

| Capital One Visa Consumer Cards | 87.50% | 15.00% | 2.50% | 12.00% | 5.00% | 3.00% | 20.00% | 5.00% | 5.00% | 5.00% | 5.00% | 10.00% |

| All Navy Federal Credit Union Visa Cards | 87.50% | 15.00% | 2.50% | 12.00% | 5.00% | 3.00% | 20.00% | 5.00% | 5.00% | 5.00% | 5.00% | 10.00% |

| Capital One Mastercard Consumer Cards | 86.00% | 15.00% | 2.50% | 15.00% | 3.00% | 5.00% | 20.00% | 5.00% | 2.50% | 5.00% | 3.00% | 10.00% |

| Bank of America® Premium Rewards® credit card | 85.00% | 15.00% | 5.00% | 12.00% | 5.00% | 3.00% | 20.00% | 5.00% | 5.00% | 5.00% | 5.00% | 5.00% |

| All Navy Federal Credit Union Mastercard Cards | 80.00% | 15.00% | 2.50% | 9.00% | 3.00% | 5.00% | 20.00% | 5.00% | 2.50% | 5.00% | 3.00% | 10.00% |

| Navy Federal Credit Union More Rewards American Express® Credit Card | 79.50% | 15.00% | 5.00% | 15.00% | 5.00% | 0.00% | 12.00% | 5.00% | 2.50% | 5.00% | 5.00% | 10.00% |

| Bank of America® Travel Rewards credit card | 78.50% | 15.00% | 2.50% | 12.00% | 5.00% | 3.00% | 20.00% | 5.00% | 5.00% | 5.00% | 5.00% | 1.00% |

| U.S. Bank FlexPerks® Gold American Express® Card | 78.00% | 15.00% | 5.00% | 15.00% | 5.00% | 0.00% | 12.00% | 5.00% | 2.50% | 5.00% | 5.00% | 8.50% |

*Citi, Synchrony, and Discover do not provide rental coverage on their cards.

Business Credit Cards

| Cards | Total Score | Vehicles Excluded | Clarity on Exclusions | Coverage Duration | Type of Road Exclusions | Country Exclusions | Loss of use and deductible on your auto insurance | Towing | Damage to tires and rims | Activation | Claims Process | Info Accessibility |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Max Score | 100.00% | 20.00% | 5.00% | 15.00% | 5.00% | 5.00% | 20.00% | 5.00% | 5.00% | 5.00% | 5.00% | 10.00% |

| All Chase Business Cards | 91.00% | 15.00% | 2.50% | 15.00% | 5.00% | 5.00% | 20.00% | 5.00% | 5.00% | 5.00% | 5.00% | 8.50% |

| Capital One Spark Cash Select for Excellent Credit | 90.50% | 15.00% | 5.00% | 15.00% | 5.00% | 5.00% | 20.00% | 5.00% | 2.50% | 5.00% | 3.00% | 10.00% |

| Capital One Spark Cash Select for Good Credit | 90.50% | 15.00% | 5.00% | 15.00% | 5.00% | 5.00% | 20.00% | 5.00% | 2.50% | 5.00% | 3.00% | 10.00% |

| All American Express Business Cards | 88.50% | 15.00% | 5.00% | 15.00% | 3.00% | 3.00% | 20.00% | 5.00% | 2.50% | 5.00% | 5.00% | 10.00% |

| All Other Capital One Business Cards | 88.50% | 15.00% | 5.00% | 15.00% | 3.00% | 5.00% | 20.00% | 5.00% | 2.50% | 5.00% | 3.00% | 10.00% |

| Capital One Spark 2% Cash Plus | 86.50% | 15.00% | 5.00% | 15.00% | 5.00% | 1.00% | 20.00% | 5.00% | 2.50% | 5.00% | 3.00% | 10.00% |

| U.S. Bank Business Visa Cards | 81.50% | 15.00% | 2.50% | 15.00% | 5.00% | 3.00% | 20.00% | 5.00% | 5.00% | 5.00% | 5.00% | 1.00% |

| Navy Federal Credit Union GO BIZ Rewards Credit Card | 77.50% | 15.00% | 5.00% | 15.00% | 5.00% | 0.00% | 12.00% | 5.00% | 2.50% | 5.00% | 5.00% | 8.00% |

| All Bank of America Business Cards | 79.50% | 15.00% | 5.00% | 15.00% | 3.00% | 5.00% | 20.00% | 5.00% | 2.50% | 5.00% | 3.00% | 1.00% |

| U.S. Bank Business Triple Cash Rewards World Elite Mastercard® | 74.00% | 15.00% | 5.00% | 9.00% | 3.00% | 3.00% | 20.00% | 5.00% | 5.00% | 5.00% | 3.00% | 1.00% |

**Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by AMEX Assurance Company. Car Rental Loss or Damage Coverage is offered through American Express Travel Related Services Company, Inc.

Methodology

WalletHub reviewed the publicly available online car rental policies of all the credit cards currently being offered by the 10 largest issuers, excluding student and co-branded offers, and collected the information needed to answer the following questions: 1) What vehicles are excluded?; 2) What other exclusions do the policies have?; 3) What is the quality of the coverage?; 4) How does one activate the benefit?; 5) How should claims be filed?; and 6) How easy it is to obtain complete policy information?

Where policies were unclear, we contacted the issuers directly and requested clarification.

Each card’s policy was scored using the following criteria:

1) What vehicles are excluded? – Worth 25% total

A. Vehicles excluded – Worth 20%

- If no exclusions apply - 20%

- If more generous than regular exclusions - 17%

- If regular exclusions apply (i.e. exotic, expensive, or antique cars; trucks; vehicles with open beds; and large vans) - 15%

- If there is a large number of exclusions - No points

B. Clarity on exclusions – Worth 5%

- If a full definition of excluded cars is provided (i.e. value and characteristics) - 5%

- If a partial definitions of excluded cars is provided (i.e. just value or just characteristics) - 2.5%

- If no description of excluded cars is provided - No points

2) What exclusions do the policies have? – Worth 25% Total

A. Coverage Duration – Worth 15%

-

- If the coverage duration is for 30 days and above - 15%

- If the coverage duration is between 20 - 29 days - 12%

- If the coverage duration is between 19 - 10 days - 9%

- If the coverage duration is between 10 - 5 days - 3%

- If the coverage duration is under 5 days - No points

*If a card provides 2 types of coverage, we averaged the 2

B. Road Type Exclusions – Worth 5%

- If Dirt and gravel roads are covered - 5%

- If Dirt and gravel roads are partially covered - 3%

- If Dirt and Gravel roads are not covered - No points

C. Country Exclusions – Worth 5%

- No country excluded - 5%

- Up to 2 countries excluded - 4%

- Up to 4 countries excluded - 3%

- Up to 6 countries excluded - 2%

- Up to 8 countries excluded - 1%

- Over 8 countries excluded - No points

3) What is the quality of the coverage? – Worth 30% Total

A. Loss Of Use and Deductible on Your Auto Insurance – Worth 20%

- If loss of use is covered - 20%

- If the deductible portion on your auto insurance policy is covered - 12%

- If the deductible from your auto insurance and loss of use not covered - No points

B. Towing Expenses – Worth 5%

- If towing is covered - 5%

- If towing is not covered - No points

C. Damage to tires and rims – Worth 5%

- If damage to tires and rims is always covered - 5%

- If damage to tires and rims is covered only when the result of theft, vandalism or vehicle collision - 2.5%

- If damage to tires and rims is not covered - No points

4) How does one activate the benefit? – Worth 5%

- If activation is standard (cardholders charge the entire rental car purchase on their credit card and decline supplemental insurance/Collision Damage Waivers (CDW) offered by the rental company) - 5%

- If activation is more complex than the standard - No points

5) How should claims be filed? – Worth 5%

- If filing a claim requires standard documentation ( i.e. a copy of the accident, a signed claim form, a rental agreement, an itemized bill and a receipt or statement showing to which card the rental was charged to) - 5%

- If claims require up to 2 documents on top of the standard documentation - 3%

- If claims require 3 or more documents on top of on top of the additional documentation - No points

6) How easy it is to obtain complete information about the policy? – Worth 10%

A. How easily can one find the info? - Worth 3%

- Information is prominent within card landing page - 3%

- Information is not prominent within card landing page; or it is prominent but users need to log in to see the full disclosure - 1.5%

- Information cannot be easily found on website - No points

B. How easy it is to read the info? - Worth 1%

- Information is presented in normal size font - 1%

- Information is in small size font - No points

C. How complete are the policies provided? - Worth 4%

- Full policy provided - 4%

- Part of policy provided - 2%

- Benefits briefly described - 0.5%

- No key details provided - No points

D. How open and transparent are issuers about the policies? - Worth 2%

- Transparent about policies - 2%

- Not transparent about policies - No points

The card with the highest cumulative percentage received the best score. The maximum percentage is 100%.

WalletHub experts are widely quoted. Contact our media team to schedule an interview.